Our Services

Senior Debt

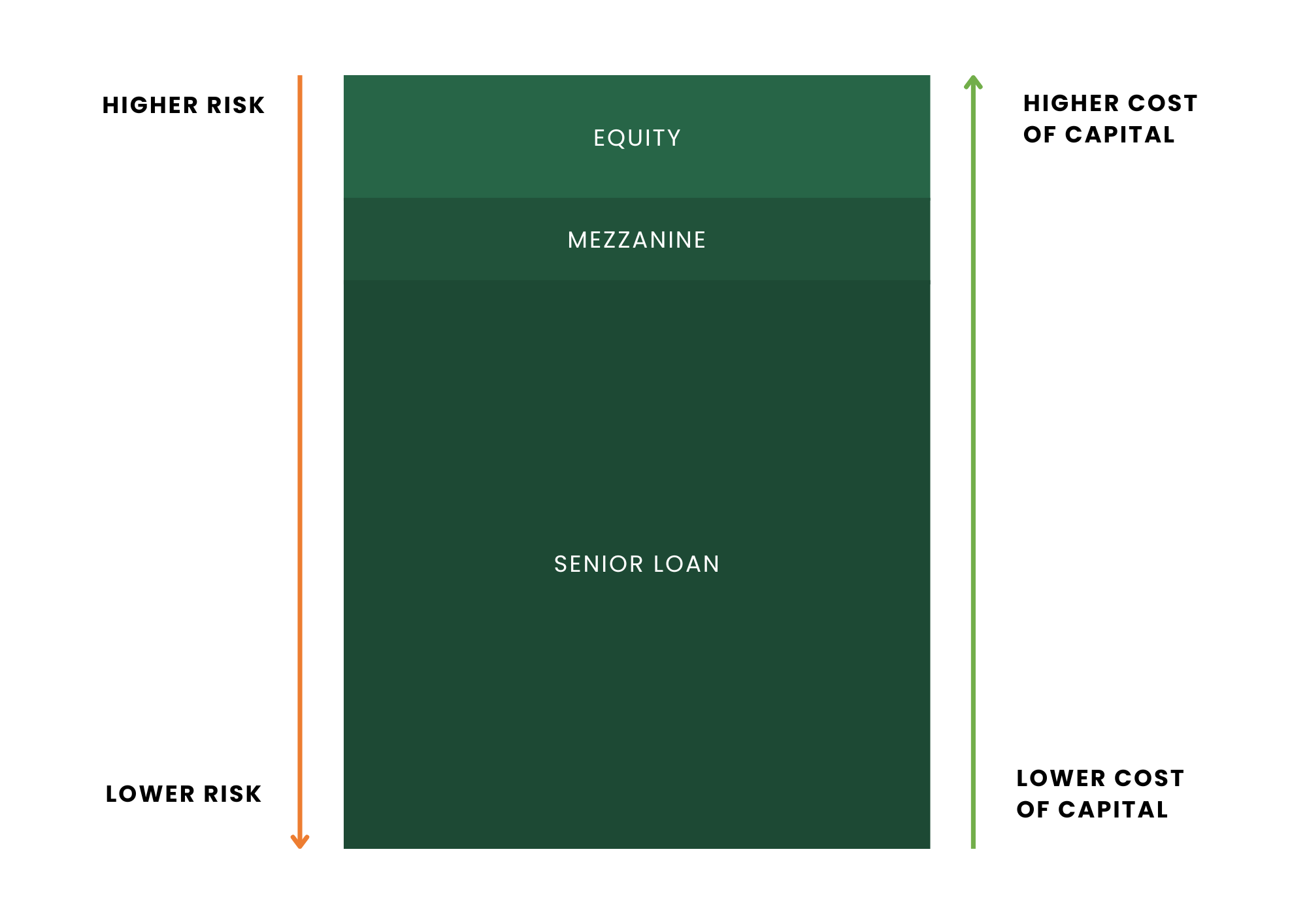

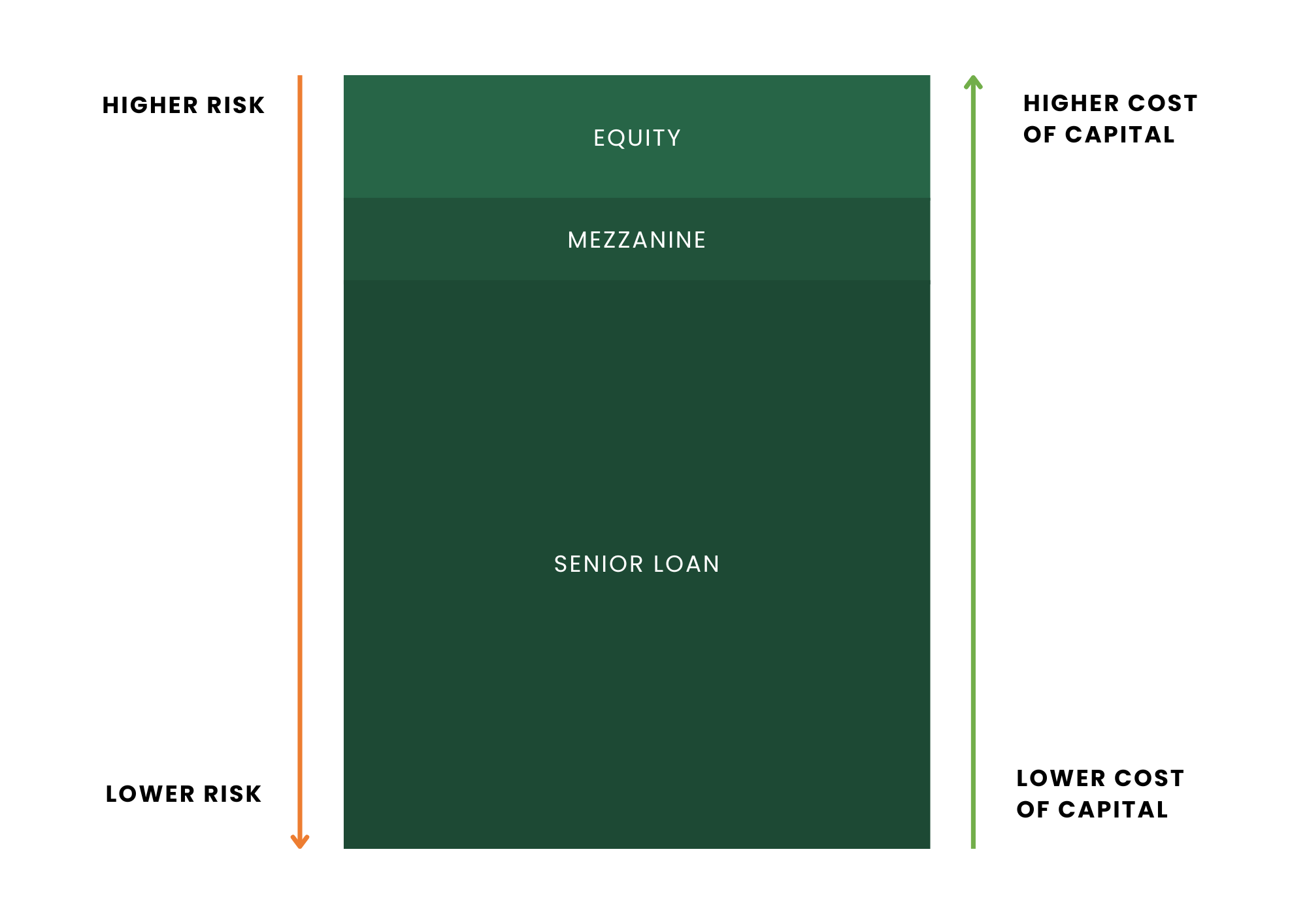

Senior debt is the highest-priority debt in the capital stack. It holds lower risk, and lower interest rates compared to subordinated debt. The largest selection of real estate lenders sit in this pool.

Bridging Finance

In situations demanding speed and flexibility, bridging provides an option. Bridging (a type of senior debt) allows our clients to navigate through planning, improvement or light refurbishment schemes for a property before transitioning to long-term investment debt or development finance or sale.

Mezzanine Debt

Mezzanine finance, also known as “junior” debt, proves valuable in various scenarios. Due to its subordinate ranking to senior lenders, mezzanine funding demands a tailored approach, with junior lenders adjusting pricing to reflect the increased risk. Despite this, mezzanine finance can offer an invaluable resource for efficiently spreading your capital across a range of projects.

Equity

An equity investor receives payment once all other lenders have been repaid. In exchange, they take a share of the profits. Investor’s therefore maintain a close interest in both the project’s management team and the underlying asset. This offering can work well for experienced professionals aiming to expand their businesses at a faster rate of growth.

We can source finance for your project, covering a range of property classes including:

Residential

Offices

hotels

Industrial

Purpose Built Student Accommodation

Retirement / Assisted Living

Build To Rent

We have access to a vast selection of funders including banks, boutique lenders and private credit funds covering all elements of the capital stack.

We ensure that you’re introduced to the funding partner that’s right for your business.